Thousands of students struggle with their student loans, primarily due to poor planning and a general lack of awareness of their options. If you are reading this, chances are you are aware that there are a bunch of ways of going about handling your student loans, two of which are student loan deferment and student loan forgiveness programs.

What is Student loan Deferment?

In a nutshell, deferring your student loans involves temporarily not making loan repayments or lowering the amount you need to pay for up to a period of three years. If you decide to opt for student loan deferment, this is what you can expect:

- You do not have to make any repayments on your loan, but you can make them if you wish to.

- If you have unsubsidized loans, interest will accrue on them during the deferment period.

Deferring your Student Loans: Yes or No?

Before you opt for student loan deferment, considering the following can help you decide if this is a good idea or not.

- If you have a subsidized loan, loan deferment can benefit you because interest will not accrue on this loan during the deferment period.

- If you can afford to make reduced payments, you should go for an Income-Based Repayment (IBR) plan, for instance. However, if you cannot afford to make reduced repayments, student loan deferment is probably your best bet.

- Keep in mind that student loan deferments make excellent short-term solutions. In other words, if you have a temporary financial setback that you can rectify soon, go for it. However, try this as a student loan deferment is a bad idea if you do not see yourself being able to make repayments in the foreseeable future.

What do you need to Qualify for Student Loan Deferments?

There are a variety of ways to be eligible for a student loan deferment. Here are a few sure-fire ways of getting your hands on one:

- If you are enrolled in a school at least on a half-time basis, you can get a student loan deferment for up to six months. However, if you are not enrolled, you can defer your loans for up to three years, as mentioned.

- If you are unable to secure a job, you can opt for a student loan deferment.

- You can apply for a student loan deferment if you happen to be undergoing cancer treatment or have completed the treatment some time within the last six months.

- Serving in the military in anything connected to a war or a national emergency can help you qualify for a student loan deferment. In such a scenario, the three-year limit does not apply.

- You can also be eligible for a student loan deferment if you find yourself in a difficult financial situation or if you are serving in the peace corps.

In addition to the criteria mentioned above, you also need to ensure you opt for the deferment of select federal loans. Such loans are Stafford loans, Perkins loan, Direct loans, and a few others. Each private loan lender has a different repayment and deferment term, so you will have to contact a few and see which one works for you. If you want to find out how a deferred payment affects your loan, consider using a deferred payment loan calculator.

Student Loan Forgiveness

Student loan forgiveness is another viable option for you to consider if student loan deferments do not work for you. Here’s how you qualify for a student loan forgiveness program:

How do you become eligible for a Student Loan Forgiveness program?

There are many ways to become eligible for a student loan forgiveness program. Here are a couple of primary ways to do it:

- If you serve in the military, you can significantly boost your chances of qualifying for a student loan forgiveness program. Keep in mind that there is a student loan repayment scheme for every branch in the military. Depending on your rank, you can get a specific portion of your loan amount forgiven.

You can also avail a student loan forgiveness program if you are a teacher. A student loan forgiveness program for teachers can help you get a maximum of $17,500 from your loan forgiven on the condition that you finish five continuous years as a teacher at a low-income institution.

Student Loan Forgiveness Programs

Here are a few student loan forgiveness programs you ought to make a note of:

Public Service Loan Forgiveness Program

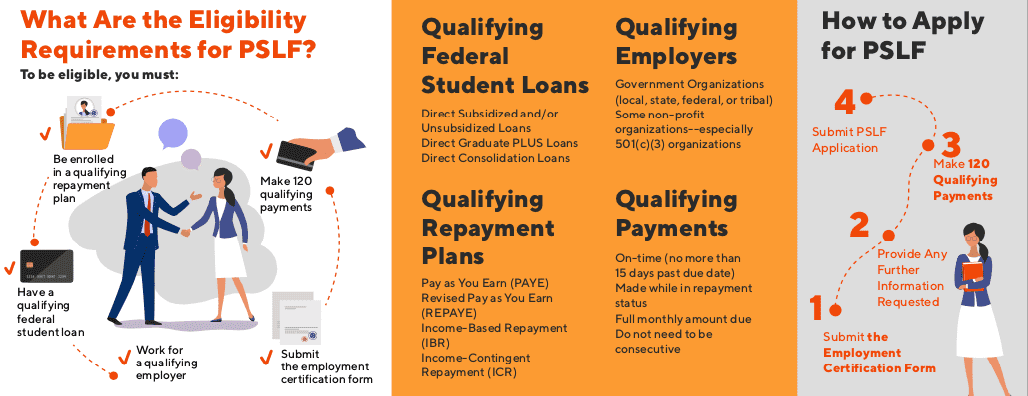

The Public Service Loan Forgiveness (PSLF) program is a very well-known and commonly used loan forgiveness program. It is specifically designed to help students with financial trouble. The PSLF Program is a federal program that helps students who are employed in the public sector.

The Public Service Loan Forgiveness (PSLF) program is a very well-known and commonly used loan forgiveness program. It is specifically designed to help students with financial trouble. The PSLF Program is a federal program that helps students who are employed in the public sector.

In other words, this program will work for you if you are working in the military, nursing, government administration, or education fields. If you want to check how much of your federal student loans can be forgiven, be sure to use a PSLF calculator.

Loan Forgiveness Due to Death

This is a loan forgiveness program that works for Perkins loan, direct loans, and so forth. If the borrower passes away, the federal student loan will get discharged. This is also the case if a student takes a Parent Loan for Undergraduate Students (PLUS) loan on the parent’s or guardian’s behalf.

This should help you formulate a plan to handle your student loans and give you the edge over your competition.